Borrower Management

• Seamless API Integration • Borrower Categorization • 360° Degree Borrower Profile • Borrower Communication

Reduce bad debt write-offs, collect money faster, increase efficiency, improve profitability, and maintain good relationships with customers.

• Seamless API Integration • Borrower Categorization • 360° Degree Borrower Profile • Borrower Communication

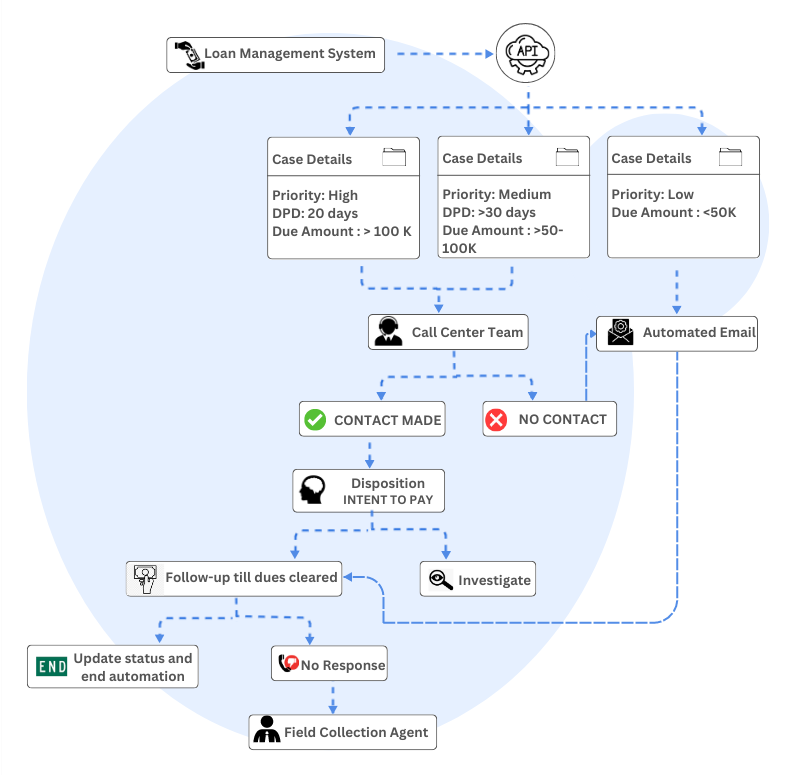

• Case Prioritization • Day Planning for Collections Agents • Automated Communication • Recovery Workflows for Collections

• Default Customer Analysis • Progressive Collection Efficiency • State of Business • Performance Tracking

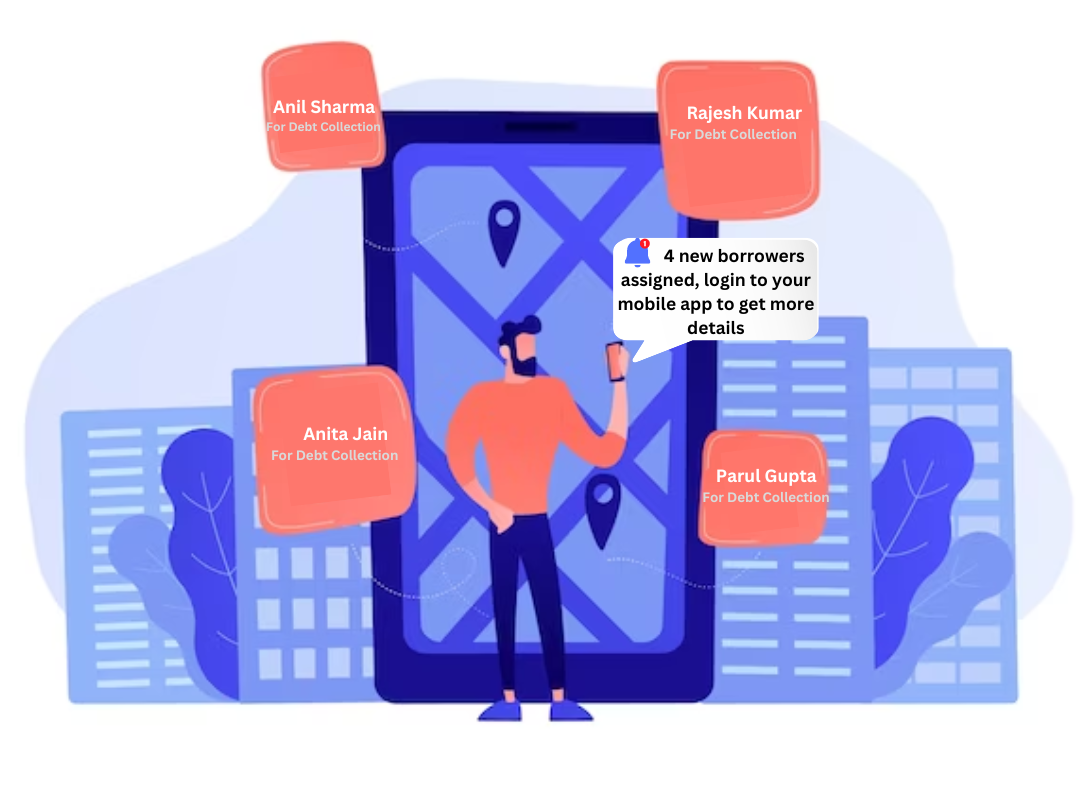

Automatically distribute defaulters to teams in different regions and the respective collections agents based on criteria like loan type, location, default amount, agent availability, agent performance, etc. Limit the count of leads getting assigned to an agent with capping logic so that he works on high-priority debts first. Have a borrower’s complete information in one place to enable your agents to connect and strike up a meaningful conversation with the borrower.

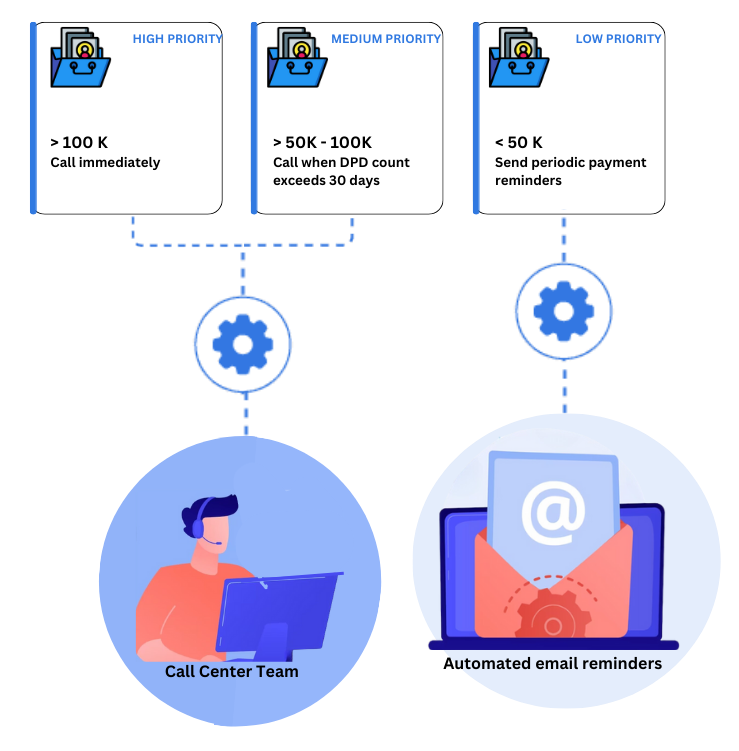

Categorize defaulters based on criteria like past due date, credit repayment history, the amount due, repayment intent, etc., and define your collection strategy accordingly. For E.g., defaulters with payment due of less than 50k can be connected via automated payment reminder emails, while borrowers with a large amount of debt would need to be called immediately.

Get alerts and notifications on events like a broken promise to pay, scheduled follow-up calls, or new borrowers assigned to them. Notification can be done via email, SMS, or any other communication channel.

Plans your collections agents’ day completely, including collections meetings in order of priority, the best routes to follow, goals for the day, and more. Increase your team’s productivity by auto-identifying possible meetings in their proximity.

Automate the whole debt collection communication from the first contact till the refund is collected. Segment your borrowers based on criteria like kind of debt, past due date, the amount due, repayment history, demographics, location, financial status, credit history, and more. Use this information to always maintain relevant messaging across all communication channels. There are ready-to-use templates for SMS, emails, and so on, which further enhance the efficiency of debt collection.

Intelligent call distribution to review loan defaulters and follow-up for Collection

Empower field agents to plan their customer visits and collection follow-ups

Updates on fraud intentions and updates on legal actions

Connect your support teams for updates on technical issues

Track your collection agent live along with a complete route plan and real-time payment, and feedback alerts. Agents can also track their pending tasks using a mobile CRM app. Managers can get complete insights on borrower profiles, agent performance, collection funnels, and more through reporting and dashboards.

.png)

Evaluate and gain insights into borrowers, agents, and collections through dashboards like borrower profiles, agent performance, collection funnels, collection performance, and more.