Unify your business on a single platform and provide borrowers and lenders, and brokers with more transparency and self-service options throughout the lending experience.

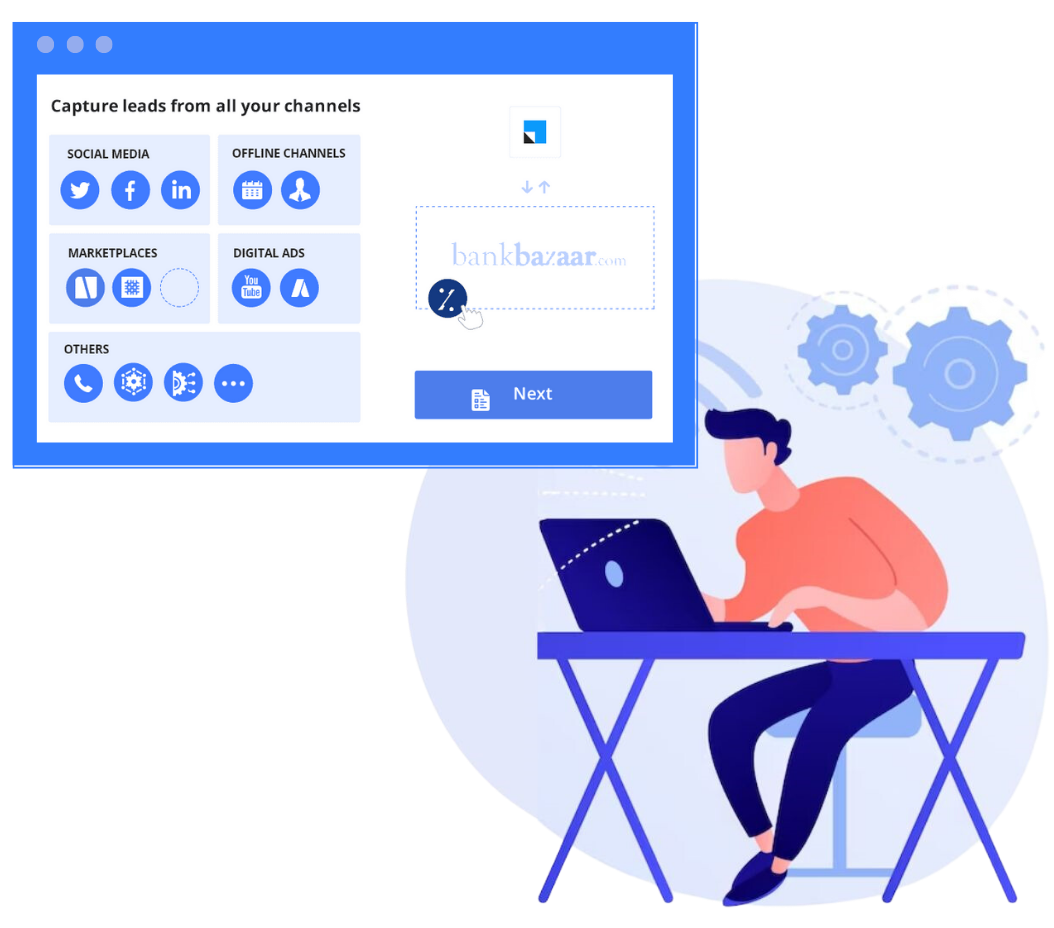

Rapidly capture loan leads from multiple channels. Channels include both - traditional and modern like phone calls, referrals, emails, social media, ad campaigns, events, websites, and DSA partners.

Borrowers can apply for loans using a fast, smooth, and mobile-friendly interface. Automatic OTP verification of mobile numbers helps to filter out junk leads. Allow the applicant to complete the application in multiple attempts, i.e., anytime they can pick it up from wherever they left.

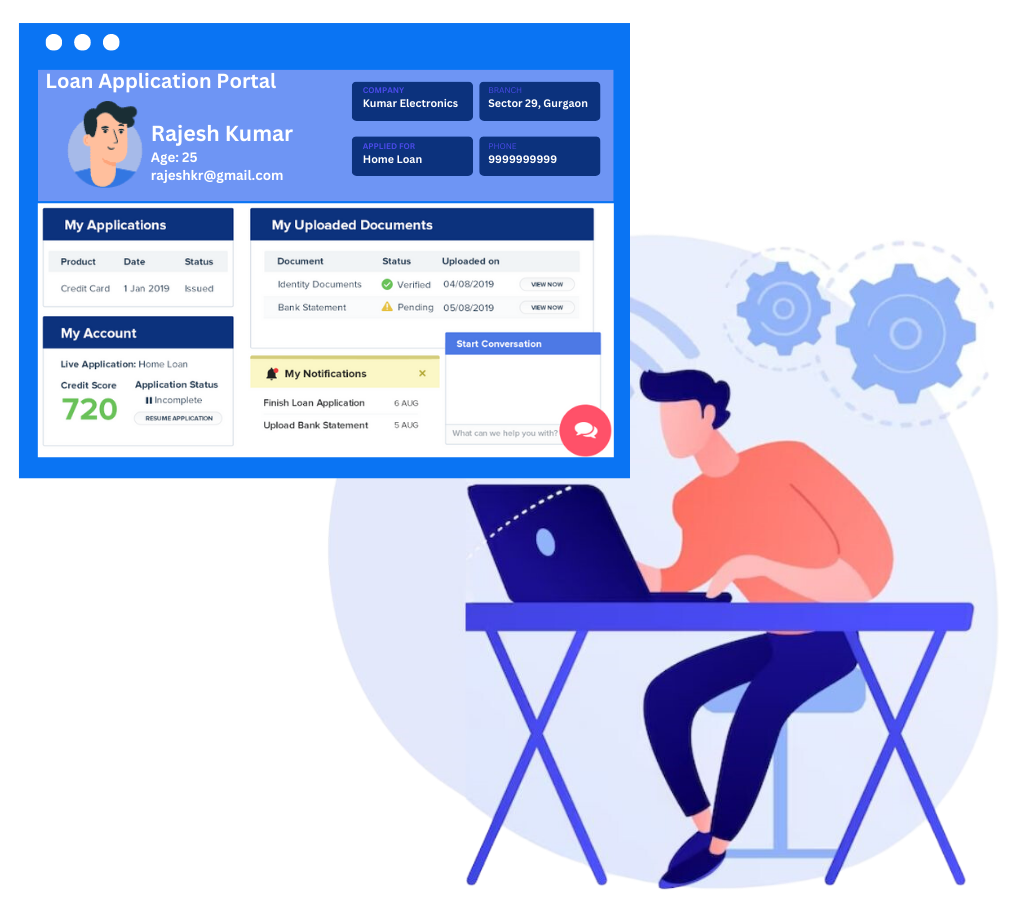

Provide a portal for your loan applicants and customers to apply for a loan, upload documents, quote generation, check application status, get notifications, check transaction history, get payments summary for upcoming, past, and late payments, options for online payments, etc. Save field agent’s time for document pick-up.

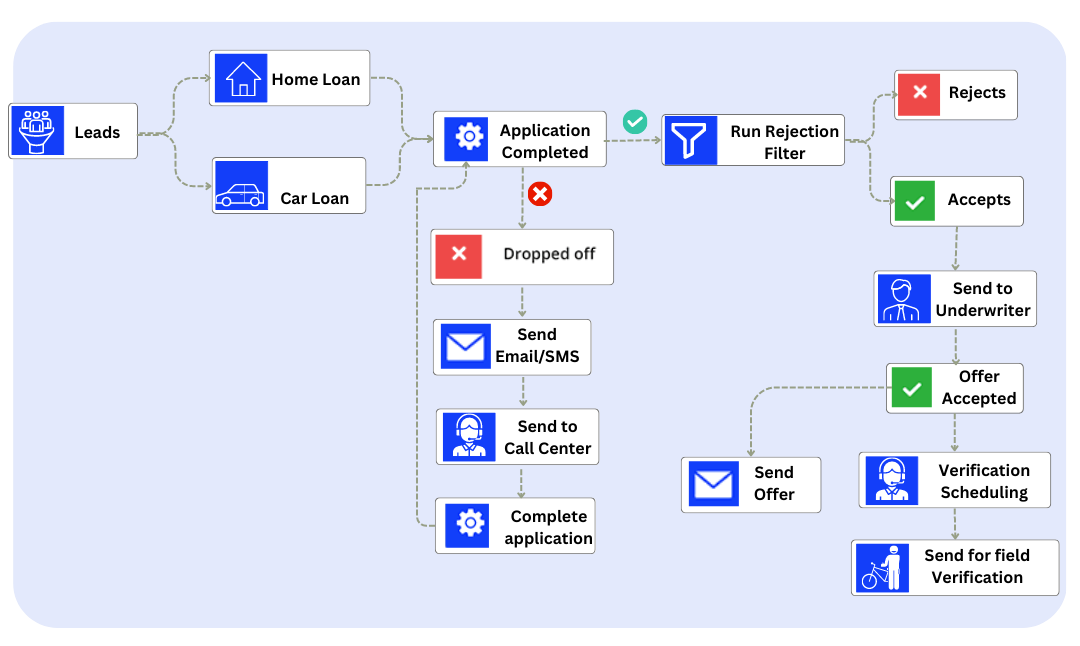

Automatic screening & follow-up process helps to prioritize genuine customers. As a result, your team does not waste time with incomplete inquiries or fake applications. Verifications like - OTP, Aadhaar Card, PAN Card, and email address verification prevents the submission of poor-quality inquiries.

.png)

Route the inquiries/loan applications to the right salespeople, underwriters, fraud control, verification, and other teams, based on the criteria that you want. Define routes based on the loan type, loan amount, verification status, application completion status, location, agent availability, performance, etc.

A call center team is one of the primary business processes in the lending industry. Every call center has a finite bandwidth that deserves maximum efficiency. Our CRM helps by filtering out junk leads and prioritizing qualified loan applications that do not close online for conversion. Therefore, the team becomes more productive and focused on actively engaging customers that add value.

.png)

.png)

Dynamic forms help your team by displaying the fields basis loan type. This gives your team a clutter-free experience when they fill applications on a borrower’s behalf, reduces the chances of manual error, and speeds up application completion.

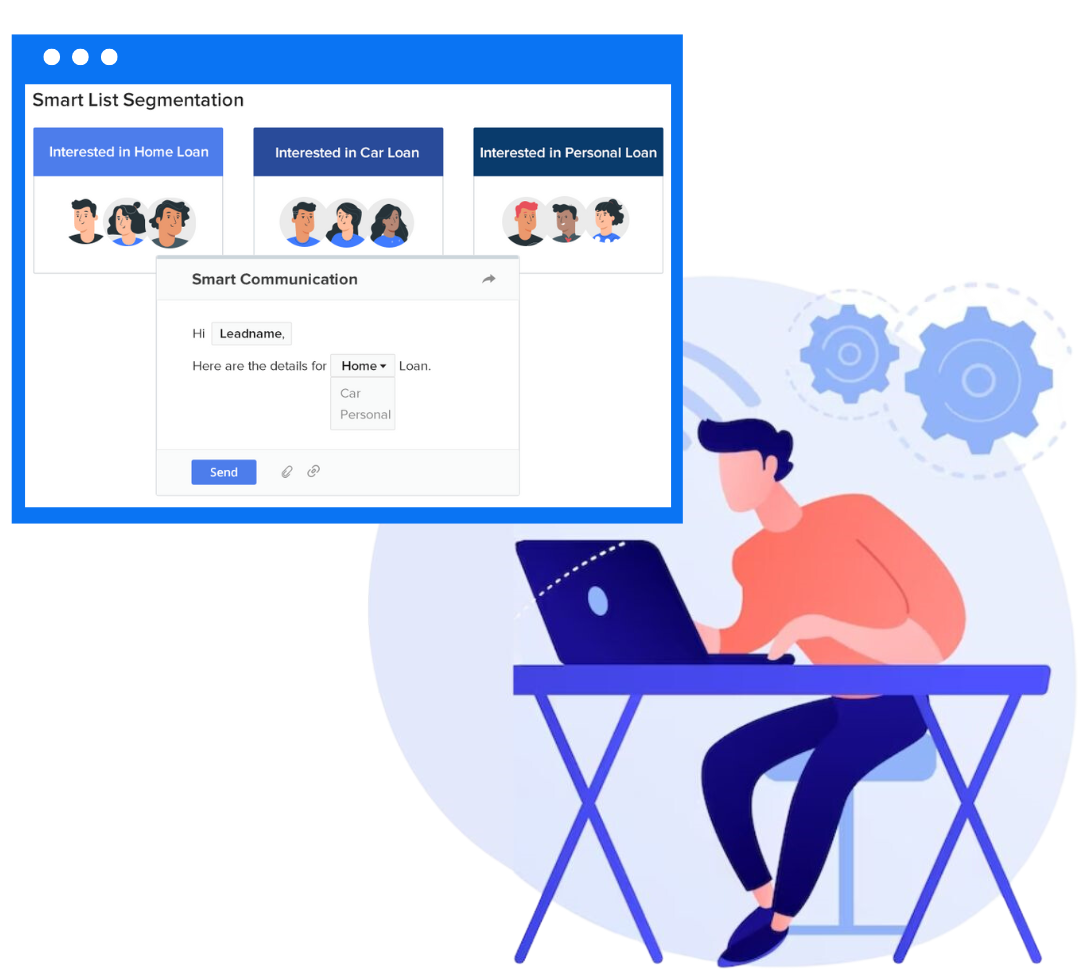

Categorize your prospective borrowers and customers based on criteria like applied loans for, application status, demographics, location, financial status, credit history, etc. Maintain relevant messaging across all communication channels basis this segmentation.

.png)

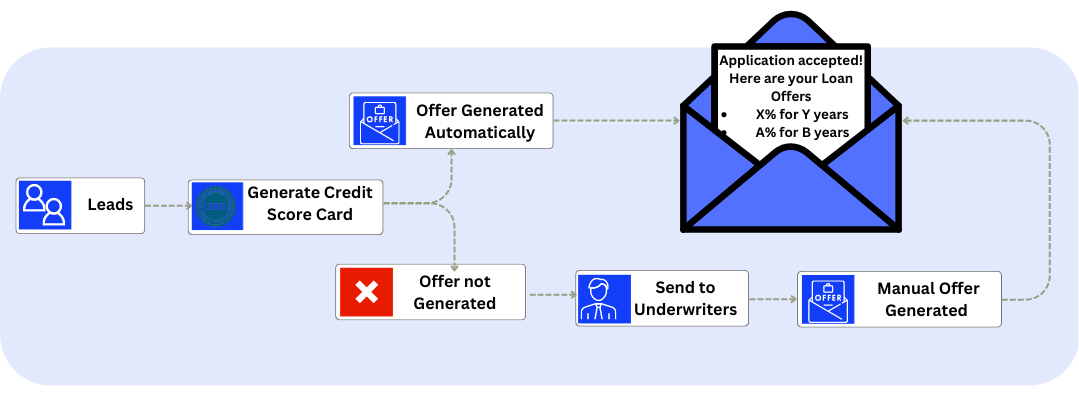

Get automatic recommendations of add-on products based on the customer’s activity on the website, and mobile app along with borrowing & repayment history. Generate pre-approved loan offers to improve customer lifetime value with the help of automated pre-screening and credit decision policies. For example, a personal loan customer with a good repayment history can be offered a pre-approved credit card or a car loan.

Use a highly secure and robust pre-built set of APIs to access third-party systems. It seamlessly accesses data from LOS, CIBIL, Experian Hunter, Perfios, NetBanking Connect, and PDF Statement Analyzer, and uses it to automate borrower qualification & offer generation. Multiple payment gateways like Razorpay, PayUMoney, PayTM, PayUBiz, Easebuzz, Authorize.Net, Stripe, and PayFast are also supported out-of-box.

.png)

Attributes like income, age, CIBIL scores, etc can be used to generate offers instantly. Therefore, you can quickly provide a soft approval to the customer and accelerates the underwriting process for quicker disbursements.

Make your field reps super-productive by organizing their day and route plans. Your agents would always know their work for the day in order of priority, goals for the day, along with the most ideal routes planned for them. This allows them to concentrate on meeting more clients, and closing more deals, rather than planning their day.

Gain visibility on your field force operations. Keep track of your field agent's customer visits with an auto check-in and check-out, geo-tracking to validate meetings, and geofencing to ensure no meeting is misrepresented. Remotely track the location, duration of each meeting, meeting outcomes, daily routes travelled, and goals achieved.

Evaluate the performance of your products, teams, and agents through reports like overall performance, team performance, etc. and reduce borrower acquisition costs, and increase operational efficiency.